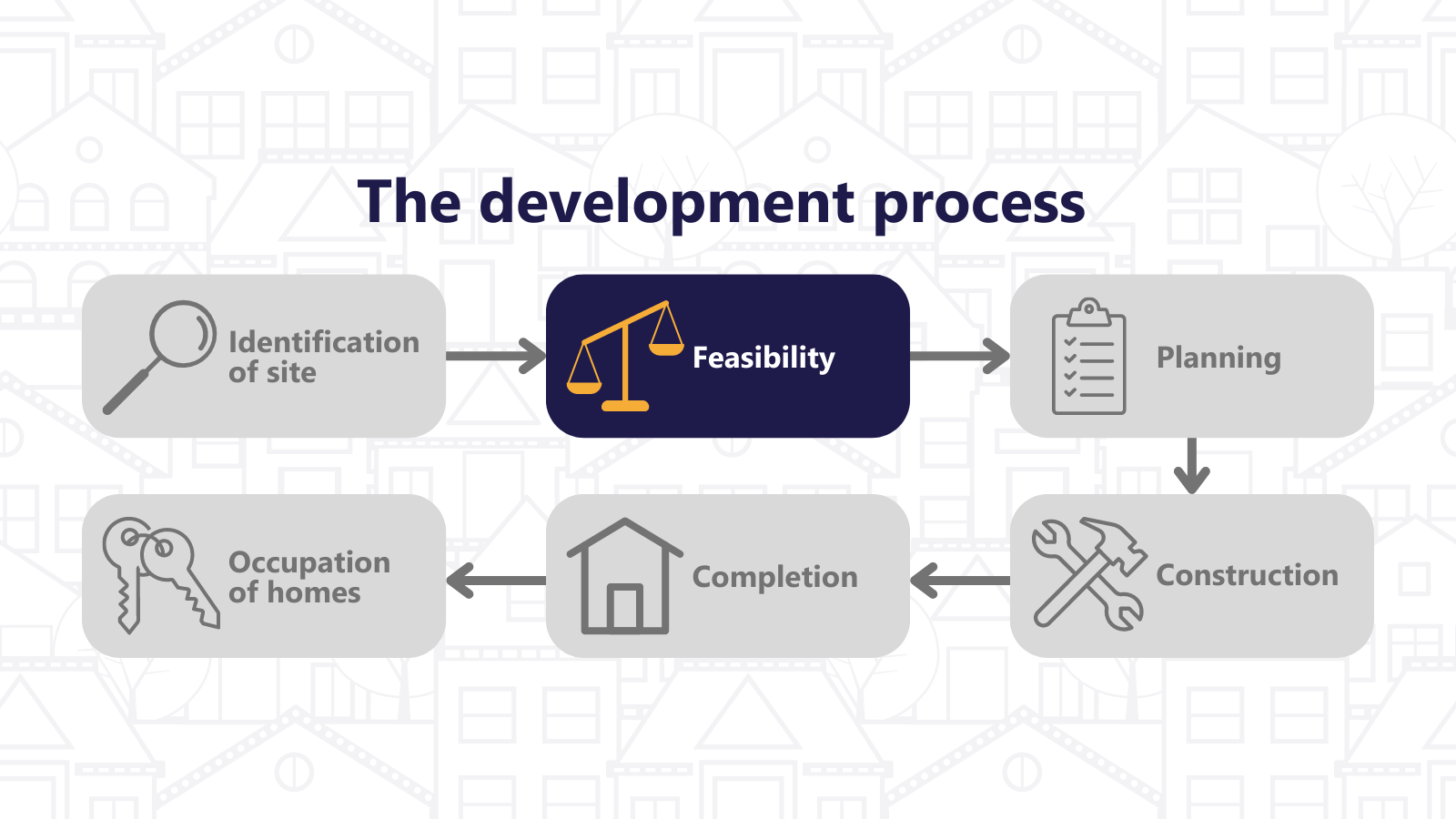

Feasibility

The feasibility study stage draws together the information gathered from the site appraisal and assessment stages as well as the opportunities and constraints identified that will inform the next stage of project development and design. Within the development process, this stage will further the exploration of the project at a more detailed stage to determine the merits of the project and to determine its viability. It will provide an objective and independent assessment of the technical, planning, legal and commercial or financial aspects of the project due diligence undertaken to date. It will review the project viability both in the short term in terms of capital investment in acquiring the site or property and undertaking the building works and importantly it will assess the long-term sustainability of the project by reviewing the management and maintenance obligations from the occupation of the new homes and the value of the initial investment against future income streams.

In summarising the reasons for undertaking a feasibility study, the following points are relevant:

• Determining an acceptable, viable purchase price for the site or property

• Establishing construction cost estimates

• Determining how many and what type of dwellings can be developed including tenure mix

• Reviewing ongoing costs of management and maintenance after occupation

• Reviewing income streams against costs to determine funding requirements and project viability

• Managing project risks and contingency planning

• Identifying project opportunities and constraints

• Decision-making and good governance

The detailed assessments at this stage will see increased time and cost resources being expended which need to be underpinned by a formal agreement or arrangement with the landowner to lock the parties together whilst the assessments are being undertaken. The work to be undertaken will include:

• Addressing issues identified at the initial assessment and survey stage

• Detailed review of physical, technical and legal issues

• Site capacity – dwelling numbers, mix and tenure

• Planning overview – policies and design

• Cost estimates

• Funding and financing sources

• Financial viability modelling

Bringing the technical, legal and planning issues noted above together for a commercial assessment will address the issue of financial viability and long-term sustainability of the project. This will determine project viability through a development appraisal model and will guide the final decision-making on whether or not to proceed or what amendments are needed to achieve a viable proposition without undermining the essence of the CLH vision. The components of a development appraisal review both short-term costs of delivery, the long-term ongoing costs of managing and maintaining the homes, and finally, the income streams in terms of potential capital grants, loan financing and rental or sales income. This is key to establishing the long-term sustainability of a development project.

The components of the development appraisal include:

• Capital costs – land purchase price, construction cost, fees

• Operational costs – day-to-day repairs, cyclical maintenance, major repairs, planned component replacement, voids, arrears, financing costs

• Financial viability model assumptions – future management and maintenance, inflation, interest rates, income streams, risk and return, grant funding

The outputs of a development appraisal will produce a series of metrics or performance indicators as to the long-term performance of the project. Whilst there are different measures, in the short term, it will be important to establish whether the capital costs of developing the new homes can be funded and to inform the search for suitable funding sources whether these be capital grants or loan financing. However, more importantly, it is necessary to establish the long-term viability or sustainability of the project. Here, a commonly used parameter that summarises all of the assumptions, inputs, costs and incomes for the project is the Net Present Value (NPV).

The NPV is a financial metric or performance indicator that seeks to capture the total value of an investment opportunity such as a CLH affordable housing project. It aims to project all of the cash inflows and outflows associated with an investment over say a 30-year period but then to discount those cash flows to the present day and then add them together whether they be positive or negative cash flows. The resulting ‘figure’ is the NPV of the investment and as such a positive NPV means that after allowing for the time value of money, the investment is viable and it will be beneficial to proceed with the investment.

Sensitivity Analysis can be used as a tool to determine viability of a project. In this instance, the analysis will vary some of the assumptions or value of input variables in a development appraisal which through their interdependence will alter the performance indicators such as the NPV, either positively or negatively. For example, this is especially important when deciding on a purchase price offer which needs to ensure that the project remains viable.

It is important to know that the purchase price offer and agreed purchase price represents a fair value given prevailing market conditions, landowner aspirations and the costs of developing that parcel of land or property.

Development land is usually valued using the so-called residual method with reference to comparable transactions. Here, an assessment is made of what prices new homes of differing types would attain in that given location given reference to comparables and sales rates. At a very basic level, those figures are multiplied by the number of dwellings of each type to arrive at the so-called Gross Development Value. From that figure is deducted the cost of developing those new homes and if appropriate a suitable margin to arrive at the underlying value of the land. In turn, this value can be affected by any onerous planning obligations as well as extra over or abnormal costs of developing the site, for example, costs of contamination remediation.

The site valuation is commissioned by the purchaser though on occasion with some vendors in the public sector, the instruction might be issued jointly and require the use of the District Valuer Service but notwithstanding these points, the following is noted:

• Instruction issued to independent RICS qualified valuer

• Site valuation through RICS ‘Red Book’ valuation

• Standard format and content of report

Key issues:

• Cost of development

• Abnormal costs, e.g. remediation costs

• Vendor/landowner aspirations

• Land supply

• Competition

• Negotiation

• Planning obligations

• Market comparables

On the basis that a viable scheme proposal exists, purchase terms can be agreed, and the agreed price confirmed by an independent valuation, it is necessary to instruct solicitors to progress the legal aspects of the transaction through the conveyancing process. At the outset, the purchase offer letters and legal instruction will need to confirm whether a freehold or leasehold interest is being acquired and provide for an agreed Heads of Terms between the vendor and the purchaser. In addition, any conditions of contract will need to be stated such as that the purchase will only be completed upon granting of a satisfactory planning consent or confirmation of a funder approval. This will allow contracts to be drafted and exchanged conditionally thereby providing further protection to the purchaser when progressing the work related to a planning application.

Some of the key issues to be addressed during the legal processes include:

• Searches – local authority, land registry, environmental

• Title documentation review

• Pre-contract enquiries

• Defective Title or other indemnity insurances (if necessary)

• Boundary confirmation of the extent of land being acquired and any disputes or potential ransom strips

• Covenants, restrictions, charges

• Rights of ways

• Easements and wayleaves

• Utility services

• Illegal occupiers

• Conditional contracts

• Legal transfer document

• Land Transaction Tax liabilities

• Confirmation and proof of funding

• Confirmation of purchaser authorised signatories to contracts

• Transfer of funds arrangements including deposits and purchase funds

• Funder legal charges

• Registration of purchase at Land Registry